Following are the “Learning Outcomes” of my “Portfolio and Equity Analysis” course and requires high-level of cognitive skills to achieve them.

- Evaluate the effect of risk and diversification on investment decisions.

- Discuss the characteristics of the various types of investments and the ways in which they are sold.

- Defend the use of mutual funds versus investing in individual assets.

- Explain the functioning of financial markets and their role in pricing investments.

- Compare the efficient market hypothesis with behavioral finance.

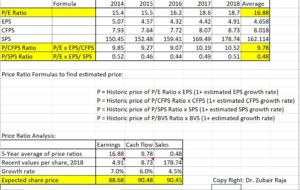

- Value equities using fundamental analysis and technical analysis.

- Analyze a company’s prospects in relation to its industry and peers.

- Use the Capital Asset Pricing Model and Asset Pricing Theory to estimate investment returns.

- Develop a portfolio management plan reflecting the goals, risk tolerance, and circumstances of individual and institutional investors.

Students are assessed based on quizzes, exams, class project and presentation. I try to align my assessments with the intended outcome of the course so that their activities should remain inline with my course objectives. For example, the class project is based on the investment in real stocks and other financial instrumented on a platform, StockTrak, which simulates the real-time investment. Likewise, my assessments are based on the student ability to analyze a particular security using available information on the internet and based on security’s characteristics and security’s contribution on his overall investment portfolio.

In line with SOLO taxonomy, I design my quizzes and exams to test that students have higher level of understandings e.g., relational or extended abstract. For example, in one of my quiz I ask my students to solve the following:

“Consider yourself a Wall street analyst. Today your supervisor has assigned you the task to find rate of return on Netflix stock. Consider Market return 9%, calculate Netflix stock beta using the weekly returns from 6 Feb 2017 to 3 Feb 2020. (use up to 2 decimal places to solve the question). Gather missing information from Yahoo finance or other related websites. Given the information the rate of return on Netflix stock is….”

Now if the student will able to solve the above question he will be able to show the highest level of understanding on the topic of “Capital Asset Pricing Model and Asset Pricing Theory to estimate investment returns”, which is the learning outcome number 8 of this course. Likewise, in order to attain the outcome number 7, I give them a detailed analysis of a company to each student and he needs to answer the following question about the company. Answering these questions involve high-level cognitive skills and students’ activity is aligned to attain learning outcome as.

Q1: What is the business, the products, the customers, what is the recent historic economic performance, what are the recent strategic decisions taken the company?

Q2: What are the key success factors and risks associated with the firm’s chosen competitive strategy?

Q3: Does the firm currently have the resources and capabilities to deal with the key success factors and risks?

Q4: Has the firm made irreversible commitments to bridge the gap between its current capabilities and the requirements to achieve its competitive advantage?

Q5: Has the firm structure its activities (such as research and development, design, manufacturing, marketing and distribution and support activities) in a way that is consistent with its competitive strategy?

Q6: Is the company’s competitive advantage sustainable? Are there any barriers that make imitation of the firm’s strategy difficult?

Q 7: Are there any potential changes in the firm’s industry structure (such as new economic conditions, new technologies, foreign competition, changes in regulation, change in customer requirements) that might dispute the firm’s competitive advantage? Is the company flexible enough to address the change?